23 Mar CK Hutchinson’s Victor Li and Canning Fok step aside as managing directors after drop in profits in 2023

Li will stay on as chairman and co-executive director with Fok, who has now also been appointed deputy chairman. The arrangement will allow Fok, 72, “to spend more time with his family”, Li said.

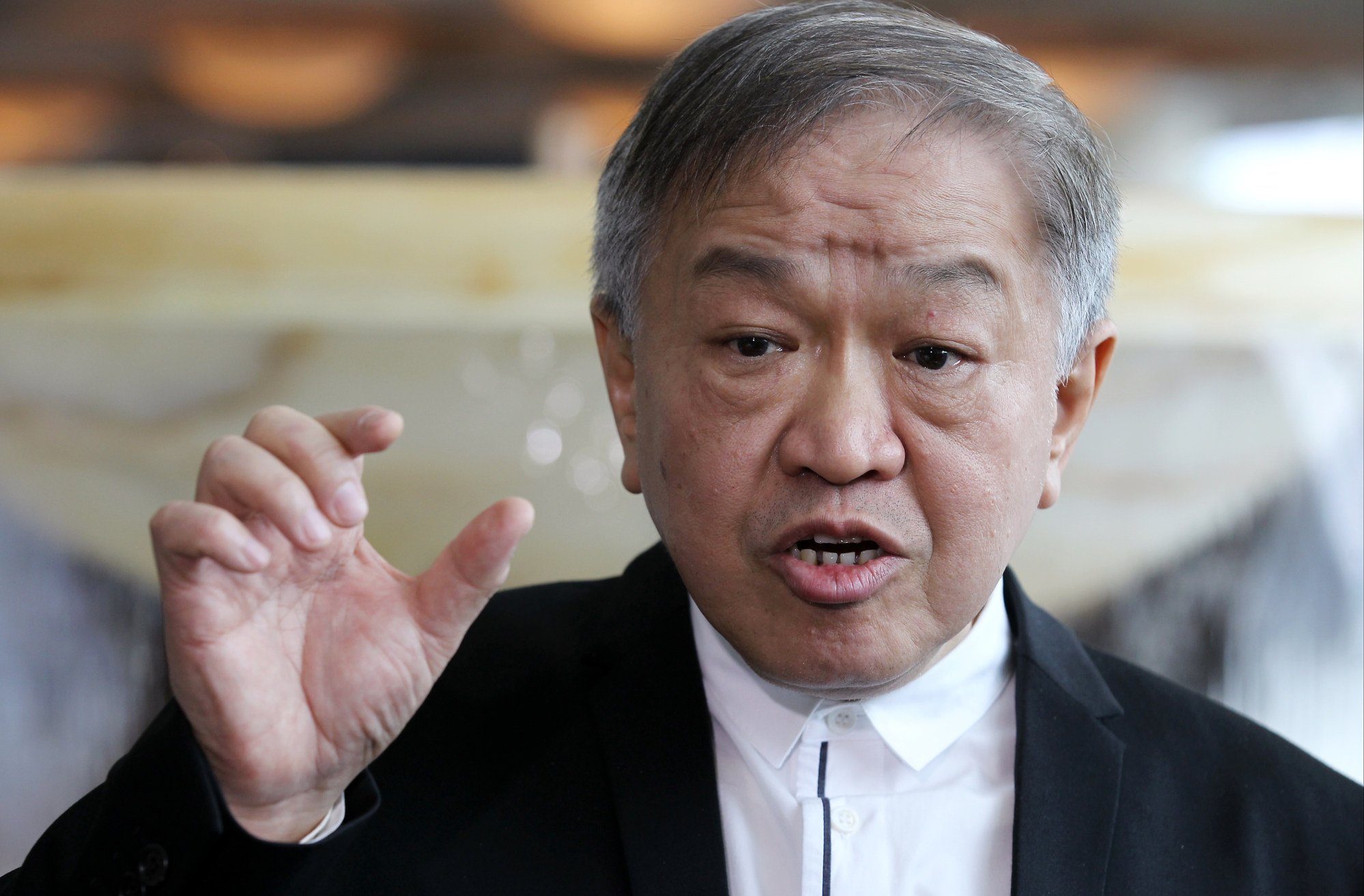

Fok decided to retire as co-managing director after decades in at the company, with 30 years as group managing director of Hutchison Whampoa, now known as CK Hutchison, and over 44 years with the Cheung Kong Group, the company said in a filing to the Hong Kong exchange on Friday night.

Fok will also be appointed executive chairman of CK Hutchison Group Telecom to lead the conglomerate’s operations in the telecommunications sector.

The incoming co-managing directors are 72-year-old Frank Sixt, who is currently the group’s finance director, and Dominic Lai Kai-ming, who is currently deputy managing director. Lai, 70, is also group managing director at AS Watson Group, CK Hutchison’s retailing.

CK Hutchison declared a final dividend of HK$1.775 per share. Together with the interim dividend of HK$0.756 per share, the full-year dividend totalled HK$2.531, a decline of 13.49 per cent from HK$2.926 in 2022.

The company’s retail division outperformed other sectors, posting year-on-year revenue growth of 13 per cent to reach HK$16.23 billion before interest, taxes, depreciation, and amortisation. It was primarily driven by favourable performance in Europe and Asia.