08 Feb HNA arm Bohai to soon start US$5 billion sale of container lessor Seaco, sources say

Bohai Leasing, a Shenzhen-listed arm of failed Chinese conglomerate HNA Group, is kicking off the sale of its container leasing business Seaco, according to people familiar with the matter.

The company is working with an adviser to solicit bids for Seaco, for which it hopes to fetch a valuation of more than US$5 billion including debt, said the people, who asked not to be identified because they were not authorised to speak publicly. Infrastructure funds may show interest in the asset, the people said.

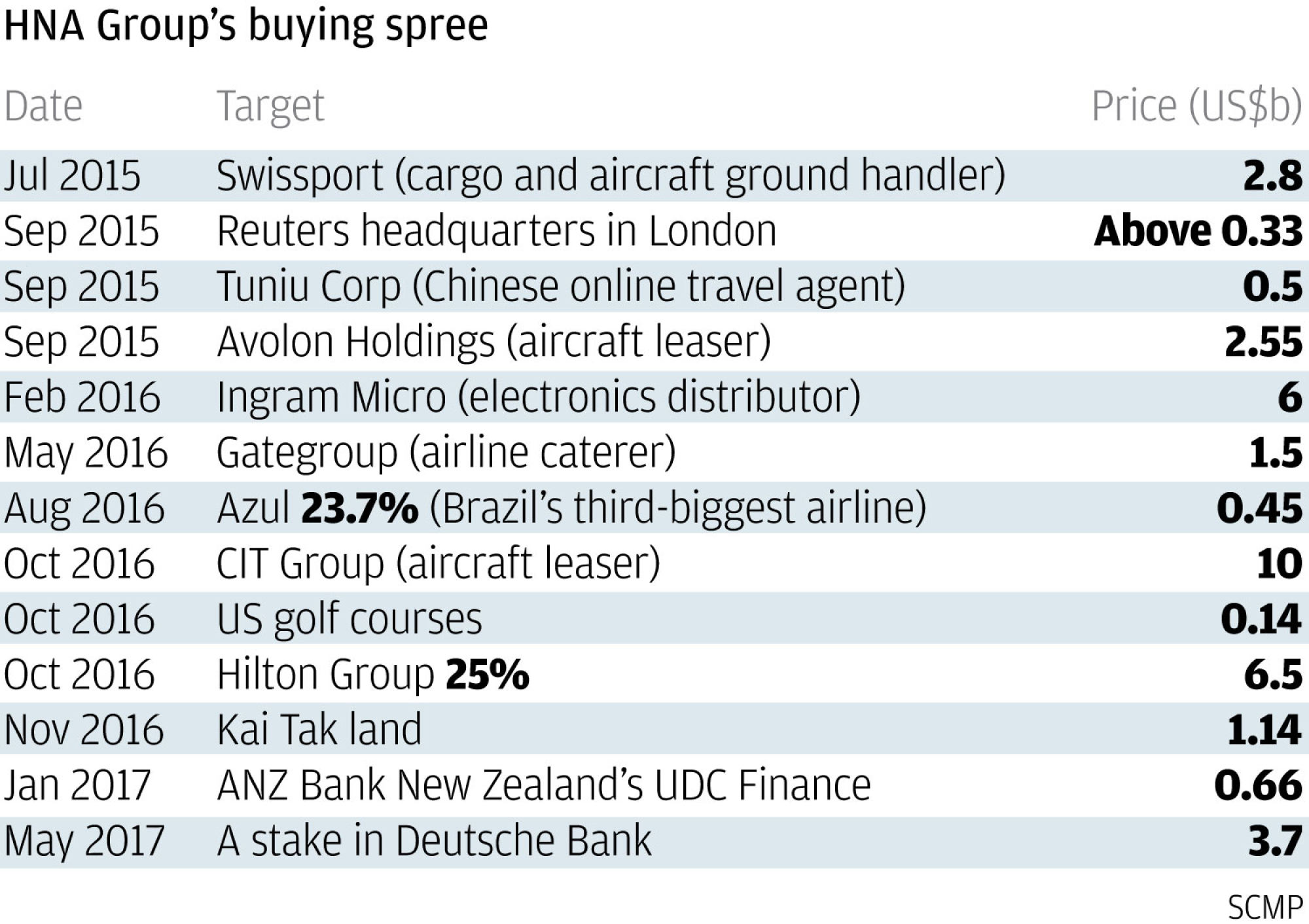

A sale would mark a major divestment for HNA as it unwinds a global deal spree that saw it snap up stakes in companies from Deutsche Bank to Hilton Worldwide Holdings. The government of China’s Hainan province effectively seized control of HNA in 2020 after it piled up one of the country’s biggest corporate leverage loads, and the company has been further downsizing its portfolio since then.

Seaco, founded in 1965, is one of the world’s largest lessors of the containers used to transport goods around the globe by ship. It offers dry freight, refrigerated, specialised and tank containers, according to its website.

The company was previously a joint venture between General Electric Capital and Sea Containers before being bought by HNA in 2011. In 2015, HNA acquired control of rival container lessor Cronos and combined its business with Seaco.

Deliberations are ongoing and Bohai may decide to keep the asset, the people said. Representatives for Bohai Leasing and Seaco did not immediately respond to requests for comment.

Bohai may seek an equity value of about US$1.5 billion to US$2 billion for the business, according to the people.

Bohai has been studying options such as divestments after struggling to refinance some of its debt, Bloomberg News reported in November. The firm has been reviewing a potential partial or full sale of its 70 per cent stake in aircraft leasing firm Avolon, people with knowledge of the matter said at the time.

Shares of Bohai have fallen about 13 per cent in the past year, giving it a market value of about US$1.8 billion.