07 Feb Hong Kong stocks extend gains spurred by China’s policy support and state buying; Haidilao surges ahead of Lunar New Year

A series of moves made by the Chinese government, ranging from new restrictions on short selling to direct state buying, have helped stocks rebound after China’s entire onshore market lost US$3.1 trillion in sell-off over the past three years, according to Bloomberg data, while another US$2 trillion was erased in Hong Kong.

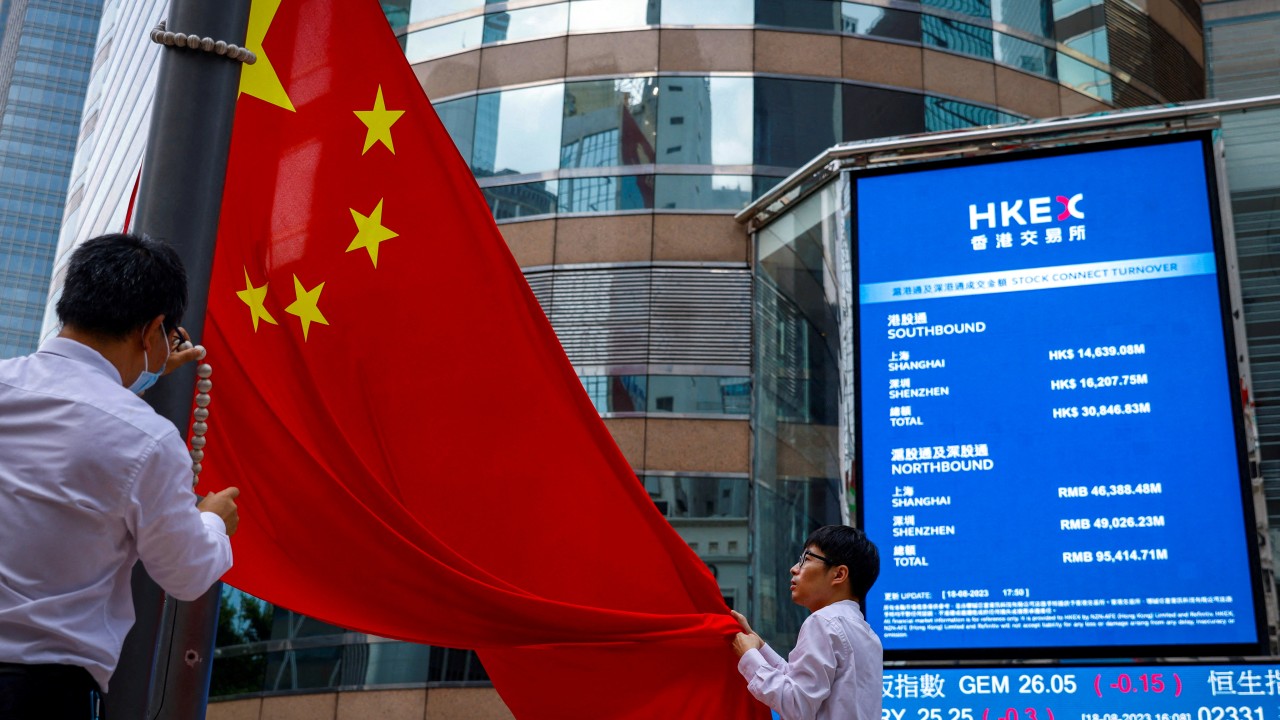

The Hang Seng Index rose 1.6 per cent to 16,387.66 as of 10.01am local time, adding to a 4 per cent gain for the previous trading day. The Hang Seng Tech Index gained 2.2 per cent and the Shanghai Composite Index added 0.7 per cent.

Chinese hotpot restaurant chain Haidilao rallied 4.9 per cent to HK$13.80 on optimism about rising demand for dining out in the run-up to the Lunar New Year. Tencent added 1.7 per cent to HK$295.60 and Meituan climbed 4 per cent to HK$72.

Alibaba Group added 1.1 per cent to HK$76.80 before the release of its quarterly result later on Wednesday that may show net income for the quarter to December fell 19 per cent from a year earlier.

Tempering gains, Semiconductor Manufacturing International Corp slumped 3.8 per cent to HK$14.76 after saying in a preliminary earnings statement that net income fell 60 per cent from a year ago in 2023.

Elsewhere, Chengdu Sino-Microelectronics Tech, a maker of integrated circuits, jumped 37 per cent to 21.57 yuan on the first day of trading in Shanghai.

Other major Asian markets were broadly higher. Japan’s Nikkei 225 slipped 0.2 per cent, while South Korea’s Kospi rose 1.7 per cent and Australia’s S&P/ASX 200 added 0.7 per cent.