06 Mar Singapore’s Mapletree, PAG rename Pan Sutong’s former Hong Kong headquarters, to give anchor tenant naming rights to ‘high-quality office landmark’

“We are thrilled to announce the re-entry of The Bay Hub as a high-quality office landmark in Hong Kong’s commercial sector,” Wong Mun Hoong, Mapletree’s regional CEO for Australia and North Asia, said in a statement issued by CBRE on Wednesday. “Aligned with Mapletree’s commitment in ESG [environmental, social and governance concerns] and creating long-term value for our stakeholders, the transformation of The Bay Hub not only brings a fresh image and vitality to the neighbourhood, its upgrades are purposefully made to cater to occupiers’ increasing demand for wellness support, sustainability and a next-level working experience.”

CBRE, however, remains confident that The Bay Hub “will remain competitive thanks to its professional asset management, inspiring working environments and best-in-class sustainability and ESG performance”, said Ada Fung, executive director and head of advisory and transaction services – office at the property consultancy.

“The Bay Hub also offers flexible leasing packages that can be tailored to the specific requirements of potential tenants, making it a good value option,” she added. Naming rights for the building are also available for an anchor tenant that wishes to establish its headquarters in Hong Kong and enjoy strong brand visibility, according to the statement.

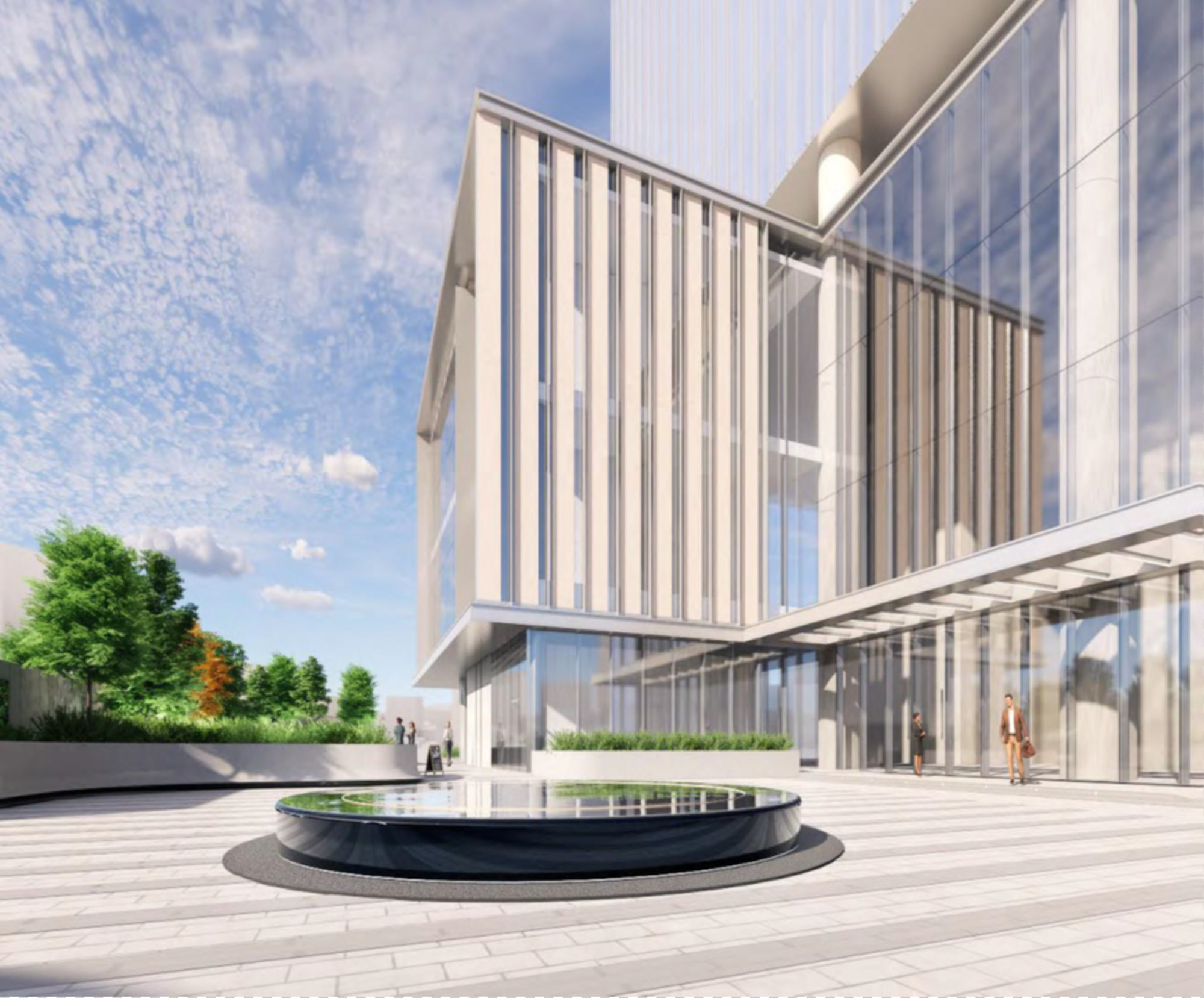

Among changes to the property are an “enhanced” north entrance that “creates a contemporary first impression”, as well as a renovated lobby and a wider range of retail and food-and-beverage options, according to CBRE. The building also has green and smart features such as a carbon dioxide-based demand-controlled ventilation on the office levels, solar photovoltaic panels on the rooftop and electric vehicle chargers on every level of the car park.

“Leveraging our experience in revitalising grade A office buildings in Kowloon East, we take pride in offering a real estate opportunity in this market that caters to the discerning needs of corporate clients,” said J-P Toppino, PAG’s president.

Goldin had been embroiled in financial distress following debt-fuelled acquisitions in the years before the Covid-19 pandemic struck in 2020. The company agreed to sell a plot at Kai Tak, Hong Kong’s former airport, for an estimated loss of HK$2.57 billion in 2020. The company was delisted from the Hong Kong exchange in October.